hmrc time to pay arrangement

COVID-19 is affecting the. The deadline before a late payment fine is issued is being extended Angela MacDonald HMRCs deputy chief executive and second permanent secretary said.

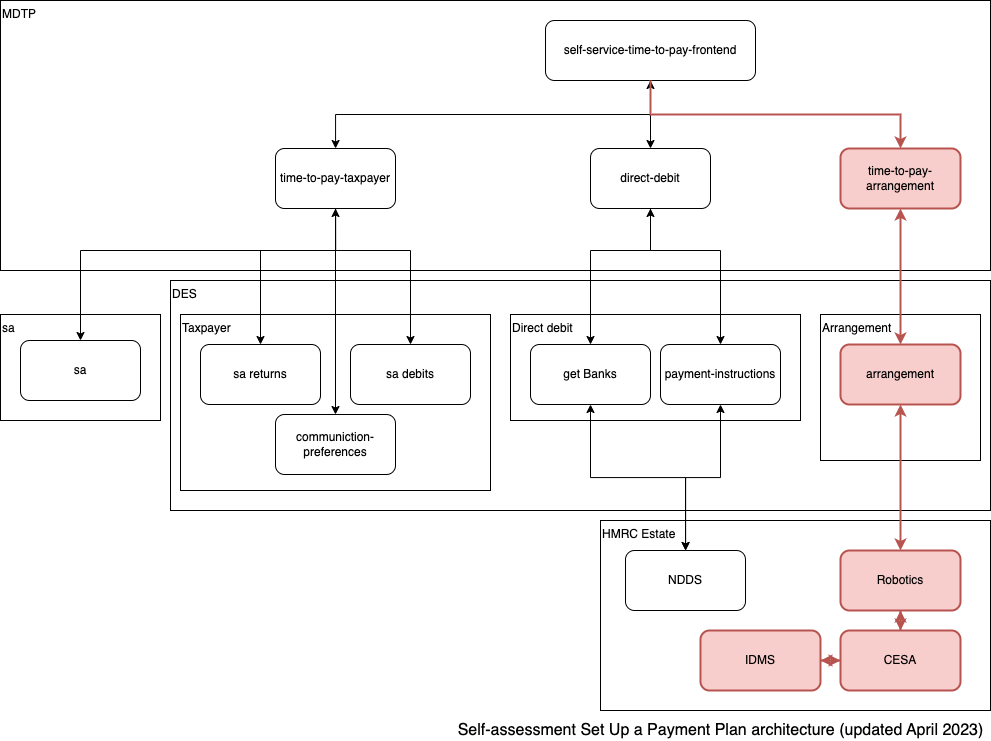

Github Hmrc Time To Pay Arrangement Time To Pay Arrangement

HMRC recognises the pressure faced this year by Self Assessment taxpayers and their agents.

. Always begin with a phone call as per the numbers below unless youve been summoned to a specific meeting with an HMRC employee. Coronavirus 0800 024 1222. Affected taxpayers should contact HMRC on 0300 200.

Property Articles Property Investor News By specialist property accountant Stephen Fay ACA. - have entered into a Time to Pay arrangement to pay off the Balancing Payment and other self assessment tax liabilities through instalments. How to contact HMRC to discuss a Time to Pay Arrangement.

While the deadline to file and pay any tax for Self. Most property investors use mortgage finance to buy their properties and so have to pay a range of lenders fees as well as interest in order to do so. HMRC should waive penalties where a time to pay arrangement has been made before the due date.

However HMRC has opted to waive these penalties in order to support those who may be struggling to complete their Self Assessment tax returns. However interest will be payable from February 1 as usual say officials so it remains still better to pay on time where possible. May 2015 Available in.

Telfords all age online community directory. For those with more serious payment problems the charities TaxAid and Tax Help for Older People provide detailed advice about tax debt and how to cope with it including advice for advisers. Because of coronavirus COVID-19 some of the rules around.

Filing well before the deadline means youll have time to sort out any unexpected problems or queries and it will also give the opportunity to set up a Time to Pay arrangement if youre going to struggle to pay this years tax bill. Penalties are imposed for late payment. Using Time to Pay HMRC will charge interest but no additional penalties interest and any outstanding penalties are covered by the arrangement.

HMRC is encouraging taxpayers to file and pay on time if they can as the department reveals that of the 122 million taxpayers who need to submit their tax return by 31 January 2022 almost 65 million have already done so. HMRC is urging taxpayers to file their returns as soon as possible. This is called a Time to Pay arrangement.

They will usually agree that you can pay it back over 6-12 months. Time to Pay Arrangements are made directly with HMRC. Welcome to Live Well Telford which provides information and signposting to a wide range of services activities and organisations in the area to help everyone find the support they need to live healthy independent lives.

Companies that have defaulted on their payments to settle their Corporation Tax VAT andor PAYE can ask HMRC for extra time to pay. Key HM Revenue and Customs Office Telephone Numbers. Late filing and late payment penalties are to be waived for one month for Self-Assessment taxpayers.

HM Revenue and Customs HMRC has decided to waive late. Are lender arrangement fees tax deductible for landlords. Tom Entwistle - 14th January 2022.

If you cannot pay your tax bill and need help you should contact HMRC as soon as possible. Anyone who cannot pay their Self Assessment tax by the 31 January deadline will not receive a late payment penalty if they pay their tax in full or set up a Time to Pay arrangement by 1 April. HMRC gives Self-Assessment taxpayers more time to pay to ease COVID-19 pressures.

This is called a Time to Pay arrangement. Self-assessment and PAYE for individuals 0300 200 3311. For Self Assessment bills you may be able to.

We know the pressures individuals and businesses are again facing. HMRC may suggest you pay what you owe in instalments. A Time to Pay Arrangement with HMRC is a debt repayment plan for your outstanding taxes.

The arrangement is based on your financial circumstances so be prepared to give HMRC this information. HMRC is encouraging taxpayers to file and pay on time if they can as the department reveals that of the 122 million taxpayers who need to submit their tax return by 31 January 2022 almost 65. Payment Problems Time to Pay 0300 200 3835.

Hmrc Time To Pay Arrangements All You Need To Know

Contractors Can Pay 2019 20 Self Assessment Bills Over Time It Contracting

Hmrc Payment Plans Explained Goselfemployed Co

What Is An Hmrc Time To Pay Arrangement Company Debt

What Is An Hmrc Time To Pay Arrangement Company Debt

0 Response to "hmrc time to pay arrangement"

Post a Comment